Crop Insurance is the Best Safety Net

“As a farmer in Indiana this year, if you didn’t get flooded out, you had a pretty good year,” says Dean Payne, director, property and casualty markets for Indiana Farm Bureau Insurance.

Unfortunately, many Hoosier farmers were affected as Indiana suffered from record floods in 2015. According to the Indiana State Climate Office, June 2015’s 9.04 inches of rain made it the wettest June ever in Indiana. June and July rainfall combined to be the second wettest in the state’s history. As a result, many areas in Indiana suffered from nearly continuous flooding in fields.

On the opposite end of the spectrum, in 2012, many of these same farmers faced severe drought conditions that drastically affected crop yields.

“Two out of the last four years have had a disaster,” says Kendell Culp, a farmer and Indiana Farm Bureau’s vice president. “If you weren’t a believer in crop insurance before, you should be now.”

Crop insurance, the federal Multi-Peril Crop Insurance (or MPCI), is a risk-management tool for farmers.

“It’s the best safety net we have in agriculture today,” says John Carroll, an Indiana Farm Bureau Insurance agent.

“Farmers this year didn’t see mild losses,” Payne says. “The flooding was a devastating loss. Crops were ruined and yields destroyed. In fact, some acres couldn’t even be planted.”

“When your land is hit with a disaster, those acres are often zero production,” Carroll says. “When you are getting zero revenue from that land, crop insurance helps fill the gap. You’d never drive your pickup or semi without insurance, and you wouldn’t leave your home uninsured. Odds are nothing will happen to your land either, but this is your income … Are you willing to take that chance?”

Many areas of the state unaffected by flooding produced record yields. Culp lost about 35 percent of his corn and 25 percent of his soybean yields, compared to an average year. As he notes, if he could have had a record-producing year as well, the potential loss is much greater.

“Crop insurance is not a luxury item,” Payne says. “It is a tool that should be built into your risk-management plan. Just as you plan for fertilizer and equipment, you should plan for crop insurance. You’re in farming for the long haul; this is part of your financial security.”

Each farmer has a different tolerance to risk, and the crop insurance program that works for one may not work for another. MPCI allows producers to buy and tailor what they need specifically for their operations.

March 15, 2016, is the deadline to purchase crop insurance. Contact your Indiana Farm Bureau Insurance agent today to develop a program that fulfills the needs of your farm, or visit infarmbureau.com.

“Crop insurance was a godsend the last few years for those that have been affected,” Culp says. “Let’s hope 2016 is better.”

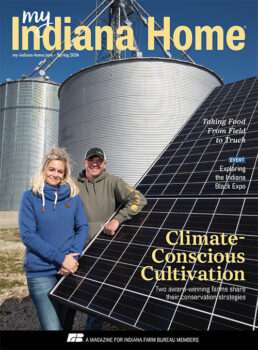

My Indiana Home is produced for Indiana Farm Bureau members. Our mission is to connect you with the food you eat, the Indiana farmers who grow it and a rural lifestyle that is uniquely Hoosier.

My Indiana Home is produced for Indiana Farm Bureau members. Our mission is to connect you with the food you eat, the Indiana farmers who grow it and a rural lifestyle that is uniquely Hoosier.

Leave a Comment